Introduction

In the ever-evolving landscape of retirement planning, persons are persistently seeking leading edge methods to take care of their fiscal future. One such process that has gained focus is the 401(k) to gold IRA rollover. This means no longer basically diversifies retirement portfolios yet also hedges in opposition to inflation and market volatility. In this accomplished article, we are going msn.com to explore the myriad advantages of transitioning from a usual 401(k) to a gold-sponsored Individual Retirement Account (IRA).

As we delve into the intricacies of this monetary maneuver, we are going to uncover how it might be an critical component to your lengthy-time period retirement technique, supplying you with defense and peace of intellect as you approach your golden years.

Understanding 401(ok) Plans

What is a 401(okay) Plan?

A 401(ok) plan is an business enterprise-subsidized retirement mark downs account that facilitates people to retailer and invest a portion of their paycheck formerly taxes are taken out. Contributions are ceaselessly matched through employers, making them an wonderful choice for building retirement wealth.

Key Features of a 401(okay)

- Tax Advantages: Contributions cut taxable profits.

- Employer Match: Many employers healthy contributions up to a specific proportion.

- Investment Options: Typically consists of mutual price range, stocks, and bonds.

- Withdrawal Penalties: Early withdrawals can also incur penalties.

Limitations of Traditional 401(okay) Plans

Despite their advantages, classic 401(k)s come with boundaries. High bills, confined funding recommendations, and vulnerability to marketplace fluctuations can prevent development attainable.

The Gold IRA Advantage

What is a Gold IRA?

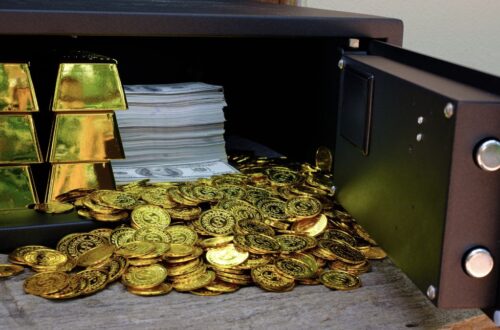

A Gold IRA is a self-directed Individual Retirement Account that allows buyers to maintain actual gold bullion or cash as component of their retirement portfolio. This style of diversification supports shelter opposed to economic downturns.

Benefits of Investing in Gold Through an IRA

Unlocking Wealth: The Benefits of a 401(ok) to Gold IRA Rollover for Your Retirement Strategy

When thinking of the transition from a 401(okay) to a Gold IRA, it’s most important to fully grasp what makes this shift so necessary.

Why Consider a Rollover?

How Does the Rollover Process Work?

The rollover activity entails shifting funds out of your modern 401(okay) plan right away into a brand new Gold IRA with out incurring taxes or penalties. Here’s how it works:

Step-via-Step Guide to Completing a 401(k) to Gold IRA Rollover

Step 1: Research Potential Custodians

Before proceeding with the rollover, it’s crucial to find an IRS-permitted custodian who specializes in dealing with gold IRAs. Look for enterprises with solid reputations and obvious fee systems.

Step 2: Open Your New Gold IRA Account

Once you’ve got specific your custodian, you could need to open an account specially certain for containing helpful metals.

Step three: Initiate the Rollover Request

Contact your current 401(k) plan administrator and request the integral varieties for rolling over your account balance into your new Gold IRA.

Step 4: Fund Your New Account

After finishing the forms, price range will be transferred at once out of your ancient account into your new one with out triggering tax liabilities.

Step 5: Purchase Precious Metals

With cash now feasible in your Gold IRA account, you should buy authorised gold bullion or coins thru your custodian.

Factors Influencing Your Decision on Rollover Timing

While rolling over from a 401(ok) to gold can present several merits, timing is primary. Consider these reasons:

- Market Conditions

- Personal Financial Goals

- Age and Retirement Timeline

- Current Economic Climate

Risks Associated with Investing in Gold IRAs

No funding method comes with no risks; expertise those talents pitfalls can help navigate them readily:

Table Comparing Traditional Investments vs. Gold IRAs

| Feature | Traditional Investments | Gold IRAs | |—————————-|————————|————————-| | Tax Treatment | Tax-deferred | Tax-deferred | | Market Dependency | High | Low | | Inflation Hedge | Limited | Strong | | Control Over Assets | Limited | High |

FAQs about the 401(ok) to Gold IRA Rollover

FAQ #1: What sorts of gold can I spend money on thru my Gold IRA?

You can spend money on IRS-accepted gold bullion or cash that meet certain purity requisites (traditionally .995% natural).

FAQ #2: Are there any penalties for rolling over my 401(okay)?

If carried out thoroughly thru direct move tools among debts, there are no penalties or taxes incurred in the course of the rollover task.

FAQ #three: Can I roll over my whole balance from my 401(k)?

Yes! You have the choice to roll over all or component to your stability right into a Gold IRA based in your fiscal objectives.

FAQ #four: How do I judge which custodian is desirable for me?

Look for custodians with wonderful stories, impressive licensing and insurance coverage insurance plan in addition to clear money platforms.

FAQ #five: Is there any prohibit on contributions once I begin my rollover?

Once you’ve got rolled over budget into your new account, you have got to adhere to annual contribution limits set via IRS guidance for IRAs.

FAQ #6: What happens if I change jobs after rolling over?

Your newly common Gold IRA remains yours no matter employment modifications; but, you should not roll over extra dollars until meeting exceptional criteria set via IRS rules.

Conclusion

In end, making the strategic transfer from a standard 401(okay) plan to a Gold IRA can greatly adorn your retirement portfolio even though safeguarding against monetary uncertainties and inflation negative aspects. By unlocking wealth by means of this rollover strategy—expertise its blessings and navigating its complexities—you role yourself favorably for lengthy-term financial success all through retirement years in advance!

Remember that each and every financial determination will have to align with exceptional pursuits and conditions; consulting with fiscal advisors skilled in helpful metal investments is wise earlier making good sized ameliorations like this one!

In abstract, regardless of whether you are looking at diversifying investments or shielding yourself in opposition t market fluctuations—eager about Unlocking Wealth: The Benefits of a 401(ok) to Gold IRA Rollover for Your Retirement Strategy should really well be one key side closer to accomplishing lasting economic independence!