Introduction

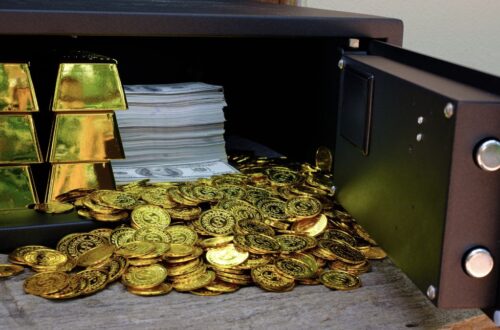

In an uncertain financial landscape, retirement safety is a top concern for people across the globe. Many people depend greatly on their 401(k) plans as a nest egg for their gold years. However, rising and fall markets and financial unpredictabilities have led numerous to check out added avenues for guarding their retired life cost savings. One progressively popular option is transforming a section of your 401(k) right into a Gold individual retirement account. This post dives deep right into the complexities of Retirement Security Via Diversification: Transforming Your 401(k) To A Gold IRA, highlighting its benefits, procedures, and frequently asked questions.

Understanding the Essentials of 401(k) Plans

What Is a 401(k)?

A 401(k) plan is a tax-advantaged retirement cost savings account offered by lots of employers in the USA. Named after an area of the Internal Income Code, this strategy allows workers to save for retirement while delaying tax obligations on contributions and revenues until withdrawal.

How Does a 401(k) Work?

Employees can select to contribute a portion of their salary to this strategy, commonly with a company suit. The contributions are bought various investment options like stocks and bonds. The collected funds can grow tax-free up until old age, when withdrawals will be exhausted as common income.

Benefits of 401(k) Plans

The Necessity of Diversification in Retirement Planning

Why Diversification Matters

Diversification is the practice of spreading financial investments throughout different asset classes to decrease threat. In retired life preparation, this strategy can considerably affect lasting safety and security and development potential.

Risks of Over-Concentration

Focusing exclusively on one type of investment– like supplies or bonds– can expose you to significant threats if that possession course underperforms. For instance, during financial recessions, stock values might drop while various other properties, such as precious metals like gold, stay secure or even appreciate.

Gold as a Financial investment Vehicle

Historical Efficiency of Gold

Gold has actually been deemed a safe-haven property for centuries. Throughout times of financial distress or inflation, gold usually maintains its worth better than conventional currencies or stocks.

Benefits of Purchasing Gold

What Is a Gold IRA?

Understanding Gold IRAs

A Gold Person Retired life Account (INDIVIDUAL RETIREMENT ACCOUNT) is a specialized type of retirement account that enables capitalists to hold physical gold and various other rare-earth elements instead of conventional paper assets like supplies or bonds.

Types of Precious Metals Allowed in a Gold IRA

- Gold

- Silver

- Platinum

- Palladium

Why Convert Your 401(k) to a Gold IRA?

The Importance of Transforming 401(k)s to Gold IRAs

Converting your 401(k) into a Gold individual retirement account provides an opportunity for diversity that may aid safeguard your retirement savings from market volatility.

Key Factors for Conversion

How to Transform Your 401k to Gold IRA Rollover?

Step-by-Step Guide to Conversion

- Choose a trusted custodian that specializes in self-directed Individual retirement accounts concentrating on precious metals.

- Complete essential documentation with your picked custodian to establish your brand-new account.

- Contact your present 401(k) carrier and demand them to transfer funds straight to your newly opened up Gold individual retirement account account.

- Once the funds are offered in your Gold IRA, deal with your custodian to pick eligible precious metals for purchase.

- Finalize purchases and ensure that the steels are stored safely within an IRS-approved depository.

- Regularly review your profile efficiency and make changes as required based on market conditions.

Retirement Security Via Diversification: Converting Your 401(k) To A Gold IRA Benefits

Enhanced Portfolio Diversity

By including gold to your portfolio through a conversion procedure, you’re expanding beyond regular stocks and bonds– reducing total risk exposure while potentially enhancing returns over time.

Long-Term Stability

Gold has revealed amazing security in its worth over years– giving satisfaction when it boils down to safeguarding one’s future economically during market fluctuations or downturns.

Common Misunderstandings Regarding Gold IRAs

Myth # 1: You Can not Gain Access To Your Funds Till Retirement

While it holds true that charges might apply if you withdraw funds prior to reaching old age; you still have alternatives like financings against certain kinds of accounts that enable minimal gain access to without severe penalties involved!

Myth # 2: Investing in Gold Is Risky

While any kind of financial investment carries some degree danger; historic trends indicate that investing in substantial assets like gold tends not just flaunt reduced volatility than equities but additionally often tends towards admiration throughout times economic turmoil!

FAQs regarding Converting Your 401k Into A Gold IRA

Q1: Can I convert my whole 401(k) into a Gold IRA?

Yes! You can convert some or all properties from your existing strategy into a new self-directed account specifically designed for holding precious metals!

Q2: Exist tax ramifications when transforming my 401k right into gold?

When executed effectively adhering to IRS laws concerning rollovers; there must be marginal tax obligation ramifications associated with moving funds directly between professional accounts!

Q3: How much can I buy my brand-new gold individual retirement account annually?

The annual contribution sandiegomagazine restrictions set forth by IRS standards dictate how much you may contribute yearly throughout various types individual accounts consisting of regular IRAs & & Roths but do not limit amount moved through rollover methods!

Q4: What are qualified precious metals I can hold within my gold ira?

Eligible alternatives consist of particular coins bars produced from.999 great silver/gold/platinum/ palladium however should meet particular purity standards described by federal standards making them appropriate investments under internal revenue service rules!

Q5: Can I physically possess my gold held inside an ira?

No! All assets held within these types accounts have to stay saved at approved depositories till circulation occurs; therefore protecting against any kind of unauthorized access prior getting to qualified withdrawal age specified under law!

Q6: What happens if I transform jobs after surrendering my old employer’s plan?

Job modifications typically position no hazard relating to formerly rolled-over amounts considering that they remain shielded under present laws governing private retired life setups no matter employment condition changes taking place thereafter!

Conclusion

Retirement Protection Via Diversity: Transforming Your 401(k) To A Gold IRA offers many advantages that could boost economic security during unpredictable times in advance while maintaining long-term development possibility through strategic allotment towards concrete properties! Welcoming diversification makes it possible for extra robust defenses against market volatility making certain preparedness when it comes time take pleasure in those hard-earned years post-retirement! By taking informed steps towards developing correct safeguards today; you lay groundwork required accomplishing long-term success throughout future undertakings bordering wealth administration strategies relocating forward!