Introduction

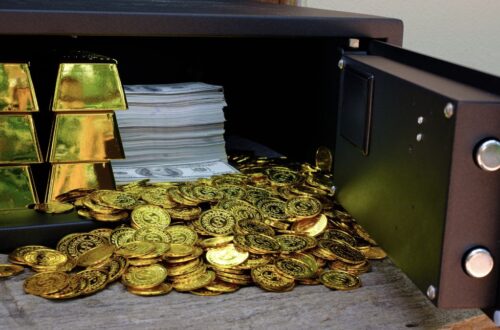

In the globe of retired life preparation, few choices have as significant an effect as where and how you spend your hard-earned cost savings. One popular choice that has emerged in recent times is the gold IRA. This investment vehicle offers a distinct method to diversify your profile and protect your wide range against economic unpredictability. In this extensive article, we’ll explore the top advantages of surrendering your 401k right into a Gold IRA, assisting you recognize why this could be the ideal step for you.

Top Benefits of Rolling Over Your 401k right into a Gold IRA

When considering the values of a 401 k to gold IRA rollover, it’s crucial to identify that protecting your retired life cost savings is extremely important. With changes in the stock market and various financial difficulties, buying gold can supply security and safety for your retired life fund.

Understanding Gold IRAs: What Are They?

A Gold IRA (Individual Retired life Account) enables individuals to hold physical gold, silver, platinum, and palladium within their pension. Unlike standard Individual retirement accounts which usually are composed primarily of stocks and bonds, a gold IRA provides concrete possessions that historically keep their value.

How Does a 401k to Gold IRA Rollover Work?

Rolling over your 401(k) right into a Gold individual retirement account involves transferring funds from your existing employer-sponsored plan right into an account specifically developed for holding rare-earth elements. This procedure can usually be completed without sustaining fines if done correctly.

Key Action in Executing a 401k to Gold Individual Retirement Account Rollover

Why Take into consideration a Gold Backed Retirement Plan?

The main factor for converting some or all of your retirement profile right into gold hinges on its historical performance during times of financial trouble. In durations of inflation or economic crisis, gold has actually proven to retain its acquiring power far better than paper assets.

Stability Versus Market Volatility

One of the most engaging factors for surrendering your 401(k) right into a gold-backed individual retirement account is its stability against market volatility. While stock markets can fluctuate hugely based upon financial conditions, geopolitical stress, and business efficiency, gold frequently functions as a safe house asset.

Historical Efficiency of Gold Investments

Historically, during times of crisis– be it monetary collapses or political turmoils– gold rates have a tendency to increase. For instance:

- During the 2008 monetary crisis

- The Covid-19 pandemic’s very early months

These events saw significant rises in gold need as capitalists sought refuge from unpredictable stock markets.

Inflation Hedge: Securing Your Wealth

Inflation wears down acquiring power; consequently, having financial investments that can endure inflationary pressures is crucial for lasting savings strategies.

Gold vs Rising cost of living Prices: A Historic Perspective

Gold has actually worked as a reliable hedge versus inflation throughout history:

- In the late 1970s when rising cost of living reached dual figures, gold rates surged.

- In modern times with rising customer rates worldwide, many financiers reverse to gold.

Thus, converting component of your retired life financial savings right into gold can safeguard you from decreasing returns caused by inflation.

Tax Benefits with Gold IRAs

Tax-Deferred Development Potential

By rolling over your 401(k) right into a gold individual retirement account, you keep tax-deferred growth on investments until withdrawal throughout retirement age. This suggests you won’t owe tax obligations on gains till you begin withdrawals at retired life age.

Avoiding Early Withdrawal Penalties

An usual concern among retirees is withdrawing funds before age 59 1/2 incurs charges; nevertheless, proper implementation of a rollover allows people to stay clear of these penalties altogether with straight transfers in between accounts.

Diversification: A Balanced Profile Strategy

In money, diversity is vital– do not place all your eggs in one basket! Rolling over component or all of your 401(k) right into precious metals not just branches out but also balances general profile threat by introducing non-correlating assets right into an investment strategy.

Creating a Well-Rounded Investment Strategy

Including physical properties like gold assists alleviate risks associated with other much more unstable financial instruments such as stocks or bonds. Right here’s just how:

|Investment Kind|Threat Degree|Connection with Supplies|| ——————-|—————-|————————-|| Stocks|High|High|| Bonds|Moderate|Moderate|| Real Estate|Modest|Low|| Precious Metals|Low|Unfavorable|

Protection Versus Economic Downturns

With worldwide economic climates experiencing fluctuations on a regular basis as a result of unanticipated conditions like pandemics or political quarrel, securing wide range with substantial assets ends up being significantly appealing.

Gold’s Durability Throughout Economic Crises

Historically speaking:

- In times when money fail or economic situations collapse (like Weimar Germany), people turn back in the direction of substantial forms (gold).

- Holding physical properties can provide assurance during uncertain times while guarding one’s wide range effectively.

Inheritance Planning Made Simpler

When preparation for future generations’ inheritances entailing precious metals comes to be advantageous because of their innate worth remaining secure in time compared to money matchings subjected straight towards inflationary pressures posthumously impacting successors monetarily down-trendlines possibly sustained by market fluctuations posthumously impacting inheritances meaningfully!

Liquidity Advantages Provided by Precious Metal Investments

Investing in physical steel gives liquidity benefits compared to traditional asset courses enabling much easier conversion back towards cash types without substantial loss counting heavily upon market conditions requiring liquidity rapidly without excessive deal fees incurred frequently associated elsewhere!

FAQ Section

FAQ 1: What is a Gold IRA?

A Gold individual retirement account is a specific retirement account that allows financiers to hold physical rare-earth elements such as gold bullion or coins rather than paper-based properties like supplies and bonds.

FAQ 2: Exactly how do I begin my 401k to Gold IRA rollover?

To initiate this procedure successfully requires picking a proper custodian proficient pertaining to IRS precious metals ira rollover regulations controling these rollovers making certain conformity preventing penalties throughout transitions!

FAQ 3: Can I roll my old company’s 401(k) directly right into my brand-new company’s plan?

Direct rollovers may occur depending upon compatibility between plans making inquiries necessary validating specifics per organization involved in advance establishing eligibility requirements laid out appropriately ensuring smooth shifts successfully executed prompt way accomplishing desired results beneficially!

FAQ 4: Are there any tax implications when doing a rollover?

Generally talking if executed correctly making use of straight transfers no instant tax repercussions develop although tax obligations use as soon as withdrawals begin later down line aging past called for minimum circulations ages stipulated inevitably requiring careful factors to consider browsing complexity surrounding taxation complexities included hereupon ruling necessary aspects influencing options made therein!

FAQ 5: Is there any type of fine if I surrender my funds incorrectly?

Executing rolls poorly without following specified guidelines could sustain substantial fines for this reason it’s crucial sticking closely recognized procedures laid out assisting security keeping conformity safeguarding rate of interests minimizing dangers potentially encountered transitioning phases throughout procedures requiring listening persistance precision applied performing activities carried out right here incorporated jointly achieving ideal end results desired herein!

FAQ 6: Can I hold various other kinds besides just Gold within my new account?

Absolutely! Numerous custodians allow holdings prolonging past merely only minimal alternatives exclusively focused only upon gold variations incorporating extra selections consisting of silver platinum palladium diversifying holdings making the most of possible returns across various spheres tactically enhancing profiles built capitalizing differing chances existing today!

Conclusion

The decision to surrender your existing 401(k) into a Gold IRA can be one full of various benefits– from providing security versus financial slumps and inflation bushes to enhancing diversification approaches within personal portfolios overall promoting long-term growth sustainability! As we’ve discovered throughout this in-depth short article on “Leading Advantages of Rolling Over Your 401k into a Gold IRA,” recognizing certain complexities entailed plays an integral role leading informed choices paving paths in the direction of effective retired lives in advance guaranteeing success delighted in across generations sustaining lifetimes fulfilled meaningfully!