Introduction

In the ever-evolving landscape of retired life planning, individuals find themselves facing a myriad of choices. Among the most reviewed are traditional Individual retirement accounts, Roth IRAs, and progressively, Gold IRAs. The last has acquired traction as a result of its unique advantages in possession diversity and protection versus inflation. This article will delve deep into the world of pension, particularly concentrating on Gold IRAs while comparing them with various other popular https://testdomain1.com retired life automobiles. We’ll discover the nuances of precious metals IRA rollover, 401 k to precious metals individual retirement account rollover, and more.

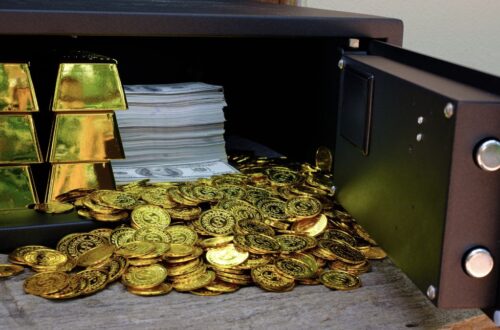

What is a Gold IRA?

A Gold individual retirement account is a specific individual retirement account that enables financiers to hold physical gold and other authorized rare-earth elements as part of their portfolio. Unlike traditional IRAs which usually consist of supplies or bonds, a Gold IRA supplies diversity with substantial assets.

Benefits of Purchasing a Gold IRA

How Does a Precious Metals Individual Retirement Account Rollover Work?

Understanding just how a precious metals IRA rollover jobs is crucial for any person considering this investment avenue.

- Eligibility: You can roll over funds from an existing 401(k) or standard individual retirement account right into a rare-earth elements IRA.

- Direct vs. Indirect Rollover: A direct rollover involves transferring funds straight in between custodians, while an indirect rollover provides you manage over the funds temporarily.

Steps for a Precious Metals Individual Retirement Account Rollover

401(k) to Valuable Metals IRA Rollover Explained

One significant benefit of buying gold is the capacity to move funds from your 401(k) into a precious metals IRA Yet how do you go about it?

Understanding 401(k) Plans

A 401(k) plan is employer-sponsored and enables staff members to save for retired life making use of pre-tax dollars.

The Rollover Process

Benefits of Rolling Over to a Rare-earth Elements IRA

- Avoid charges if done properly via direct rollover methods.

- Gain exposure to the stability used by precious metal investments.

401(k) to Gold IRA Rollover Without Penalty

It’s natural to fret about charges when moving retirement funds about, yet there are ways to execute this without incurring costs.

How Can You Avoid Penalties?

- Utilize Direct Rollovers: As previously pointed out, selecting direct rollovers prevents taxes and fines from being deducted at the time of transfer.

- Adhere to IRS Standards: Make Certain that you’re complying with all IRS policies pertaining to rollovers.

Common Mistakes to Stay clear of During Rollovers

Comparing Standard Individual retirement accounts with Gold IRAs

When it comes down to picking between traditional IRAs and gold-backed accounts, it’s necessary to weigh several factors:

Investment Options

- Traditional Individual retirement accounts mostly enable supplies, bonds, and mutual funds.

- Gold Individual retirement accounts permit physical gold and other authorized precious metals like silver, platinum, and palladium.

Market Volatility

Traditional financial investments are usually much more at risk to market swings compared to gold’s historical stability throughout financial crises.

Gold vs Roth IRAs

Roth Individual retirement accounts provide tax-free growth on contributions made after tax obligations; nonetheless, they lack the tangible property nature of Gold IRAs.

Tax Implications

Investors ought to consider their present vs future tax obligation bracket when making a decision in between these 2 accounts:

- Roth IRAs allow for tax-free withdrawals at retired life age

- Contributions made toward Gold IRAs might still drop under regular revenue taxes upon withdrawal unless done strategically

Navigating Your Alternatives: Contrasting Gold IRAs with Other Retirement Accounts

Choosing between various kinds of retirement accounts typically really feels overwhelming– yet it doesn’t require to be! It’s essential initially to identify individual monetary objectives before diving into various account types.

Risk Resistance Assessment

Take a long time assessing how much threat you’re willing or able to take on:

Long-term Goals

Consider your long-term financial desires:

By understanding these facets better, you can make educated choices regarding whether purchasing gold matches your needs best!

FAQs Regarding Purchasing Gold IRAs

What are the charges associated with opening up a Gold IRA?

Fees typically consist of setup costs, yearly maintenance fees, purchase costs for buying/selling properties, and storage costs if applicable.

Can I hold physical gold coins in my Gold IRA?

Yes! Nonetheless, they must satisfy specific criteria set forth by IRS regulations pertaining to purity degrees (such as American Eagle coins).

Is there any kind of limit on how much I can add annually?

Yes! The payment limits straighten with those set forth by traditional/roth individual retirement accounts; check internal revenue service guidelines consistently as they might change yearly!

What happens if I desire early access/my cash prior to getting to age 59 1/2?

Early withdrawal could sustain penalties unless qualifying exceptions use (i.e., impairment). Seek advice from better paperwork prior to proceeding!

Are returns created from my financial investments taxable?

Dividends obtained with investments held within any type of type of specific retired life account aren’t taxed up until withdrawn– so delight in those profits growing untaxed up until then!

How do I choose a certified dealer for purchasing my physical metal assets?

Research suppliers thoroughly! Look out for reviews/testimonials online while guaranteeing they have suitable licensing/certifications needed by federal/state legislations controling purchases entailing valuable products like gold/silver etc.,

Conclusion

In verdict, navigating your alternatives in between numerous retirement accounts requires due persistance and consideration of personal economic goals in addition to threat tolerance degrees integral within each investment technique available today– from traditional vehicles such as stocks/bonds/mutual funds versus alternative ones like spending directly into tangible properties with avenues such as precious steels ira rollover possibilities among others discussed here today!

By weighing benefits against prospective disadvantages carefully while staying informed concerning pertinent market problems affecting these options lasting– capitalists stand poised towards accomplishing effective results ultimately leading them better in the direction of achieving desired monetary self-reliance within their respective lives ahead!