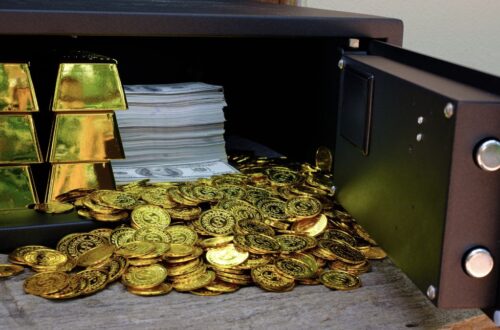

As economic uncertainties continue to influence financial markets, many investors are seeking ways to protect their retirement savings. One popular strategy is rolling over a 401k into a Gold IRA. This approach offers diversification and a hedge against inflation. In this article, we explore the top companies offering Gold IRA rollover to 401k options, providing insights into their offerings, customer service, and reputation.

Understanding the 401k to Gold IRA Rollover

A 401k to Gold IRA rollover involves transferring funds from a traditional 401k account into a Gold Individual Retirement Account (IRA). This process allows investors to hold physical gold and other precious metals as part of their retirement portfolio. The benefits include diversification, protection against currency devaluation, and potential tax advantages.

Why Consider a Gold IRA?

- Diversification: Gold offers a way to diversify beyond traditional stocks and bonds.

- Inflation Hedge: Historically, gold has maintained its value during inflationary periods.

- Stability: Precious metals can provide stability during economic downturns.

Top Companies for 401k to Gold IRA Rollovers in 2024

Several companies stand out for their expertise and customer satisfaction in facilitating 401k to Gold IRA rollovers. Here, we review some of the top contenders.

1. Augusta Precious Metals

Augusta Precious Metals is renowned for its customer-centric approach and educational resources. They offer a streamlined rollover process and have a strong reputation for transparency.

- Customer Service: Highly rated for personalized service and educational support.

- Fees: Competitive pricing with no hidden charges.

- Reputation: A+ rating from the Better Business Bureau (BBB).

2. Goldco

Goldco is a leader in the precious metals industry, known for its comprehensive services and experienced team. They provide a seamless rollover experience with a focus on customer satisfaction.

- Customer Service: Dedicated account managers to guide clients through the process.

- Fees: Transparent fee structure with no surprise costs.

- Reputation: Excellent reviews and high ratings from industry watchdogs.

3. Birch Gold Group

Birch Gold Group offers a wide range of precious metal products and has a strong track record in the industry. Their team of experts assists clients in making informed decisions about their retirement investments.

- Customer Service: Known for their educational approach and responsive support.

- Fees: Clear and upfront pricing.

- Reputation: Positive feedback from clients and industry experts.

4. Regal Assets

Regal Assets is a well-established company with a focus on alternative asset investments. They offer a straightforward rollover process and a wide selection of precious metals.

- Customer Service: Strong emphasis on client education and support.

- Fees: Competitive rates with no hidden fees.

- Reputation: High ratings from consumer advocacy groups.

Case Studies and Success Stories

Many investors have successfully transitioned their 401k accounts into Gold IRAs, reaping the benefits of diversification and stability. For instance, a case study involving a mid-career professional showed significant portfolio growth after diversifying with gold during a market downturn. This example highlights the potential advantages of including precious metals in retirement planning.

Statistics and Market Trends

Recent statistics indicate a growing interest in Gold IRAs. According to a 2023 survey by the World Gold Council, 15% of investors are considering gold as part of their retirement strategy, up from 10% in 2020. This trend reflects increasing awareness of the benefits of precious metals in safeguarding retirement savings.

Conclusion

Choosing the right company for a 401k to Gold IRA rollover is a significant decision that can impact your financial future. Augusta Precious Metals, Goldco, Birch Gold Group, and Regal Assets are among the top options for 2024, each offering unique strengths in customer service, transparency, and industry reputation. By exploring these companies, investors can make informed choices to protect and grow their retirement savings through diversification with precious metals.